Due to current high volatile market, here is a quick mid-quarter update on the US market volatility and the fund’s performance in the quarter:

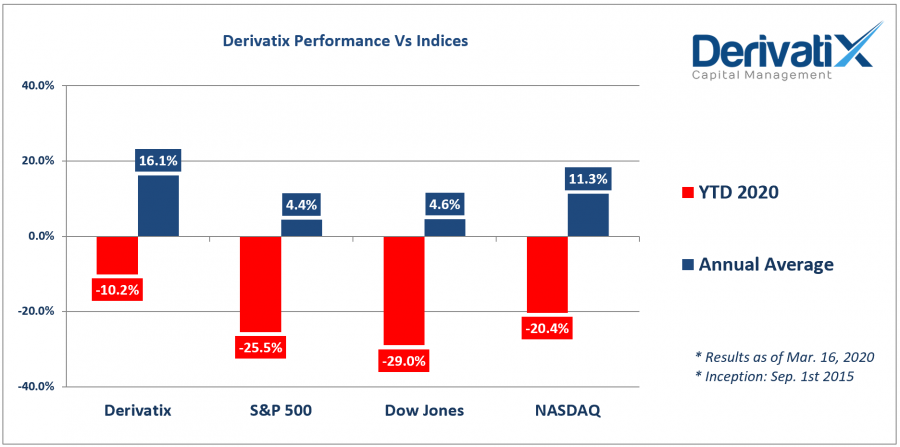

Major US market indices started a sharp drop in late February and continued the decline into March on the global fear of the negative impact of coronavirus on the overall economy. As of March 16th, S&P500 and Dow Jones Industrial Average were down 25.5% and 29% respectively while Nasdaq dropped around 20%.

In this extreme environment, the protections we have continuously added into the fund’s positions, helped us to absorb the majority of this large drop and slowed down the fund’s decline around 10% level for the same period. Right now, the fund has less correlation to the future market fluctuations since we have already reduced the exposure.

Besides protecting short term positions and managing the near-term exposures as mentioned above, we have placed long term positions that would benefit from the long-standing market growth and yield into the performance down the road for the rest of the year.

Although the market has started very volatile and unstable in 2020, the trading strategy and risk management methodology we utilized inside the fund, enables us to keep holding long term growth despite short term pressures. In fact, we anticipate a high probability of finishing this year in a positive return as we did in 2018 when the market experienced a couple of large plunges in that year yet those drops didn’t prevent Derivatix to post a positive net return in 2018.

While market corrections and declines are considered terrifying and intended to be avoided, they can be seen as unique opportunities if you are ready to seize the moment IF ONLY you protect your assets effectively at the same time. Despite the overall fear to leave the down market, it is the time to add in.

Please contact me if you have any questions or concerns in this regard. I would be happy to talk more in person.

Stay home safe,

Maziyar Yousefizad

Fund Manager

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.