February started as a wake up call for the steadily market long run. The monster has woken up guys – No more free ride!

Spreading fear all over the floor, the overall US market tumbled about 10% before starting to recover by the end of February. Among the indices we monitor, Dow Jones (once the strongest) hurt the most ending this month with 4.3% loss. S&P experienced 3.6% drop while NASDAQ managed to recover much faster and finished February with only a modest 1.3% decline. We also suffered from this massive market drop yet thanks to our early added protection, we managed finish February at 2.8% decline.

Do you think it is over? Think again…

While, it was perceived that the turbulence is over and the market is back to track, then comes the monster March. March claimed its own power and pushed the market back down again, close to the same low level of early February. This time, NASDAQ hit the most and lost -4.2% but due to its fantastic January gain (if you forgot, it was about 9%!) could end up the first quarter of 2018 in 2.8% profit. However, that was not the case for S&P and Dow Jones since their damage in March forced them both to eventually record a quarterly loss after a long time.

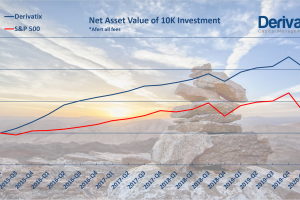

How about the Derivatix fund? Derivatix managed the market volatility in March and finish it in a moderate 1% profit. This helped us to land at 2.3% gain in this rough quarter. In the long run since inception, Derivatix is up 79% after 31 months. At this period, the average annual gain of the fund was 25% while S&P500 and NASDAQ raised 12% and 18% per year respectively.

We estimated a more side-way market in 2018; gyrating in a wide range rather than going directional. This would be a much-suited behavior for our original trading strategy which was long waited.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.