with almost no overall change. S&P500 and NASDAQ added only 0.5% while Dow Jones showed no gain

in this month.

As previously mentioned, that is the desired situation for our sideway trading strategy where we bet on

the market’s gyration within one standard deviation of its historical volatility. Accordingly, while April

didn’t help the overall market to grow much, it did help us to make a good monthly profit.

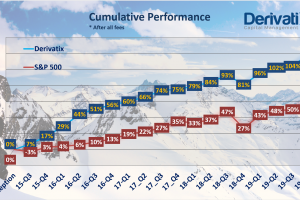

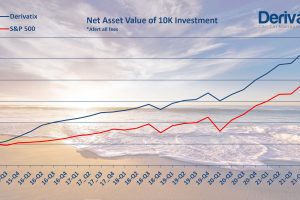

Derivatix made 1.5% net profit in April which is 3 times higher than S&P500 and NASDAQ growth at this

month. This helped the fund to make 3.8% net profit for 2018 while NASDAQ was up 3.3% and the other

two (S&P500 and Dow Jones) are still negative territory year to date. Eventually, since fund’s inception

32 months ago, Derivatix is up almost 82%. That is about 25% average annual net growth after all fees.

It is expected that the US Market stays in a wide range in the rest of 2018 as performed in April which in

turn provides the fund with more sideway setups and chances to beat the benchmarks in this year.

That would be a great opportunity to join the fund to enjoy the ride!

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.