Summer is here ladies and gentlemen. Enjoy it before it goes fast….

2022-Q2 Market Summary*:

Recession fears and an accelerated Federal Reserve (Fed) interest rate hiking trajectory weighed on markets during the second quarter, resulting in the weakest first half performance since 1970. Supply shocks and robust U.S. consumer demand kept inflation and the Fed in the spotlight. But higher inflation and the sharp rise in yields are taking their toll, with consumer and manufacturing data beginning to show signs of deterioration.

Derivatix Performance:

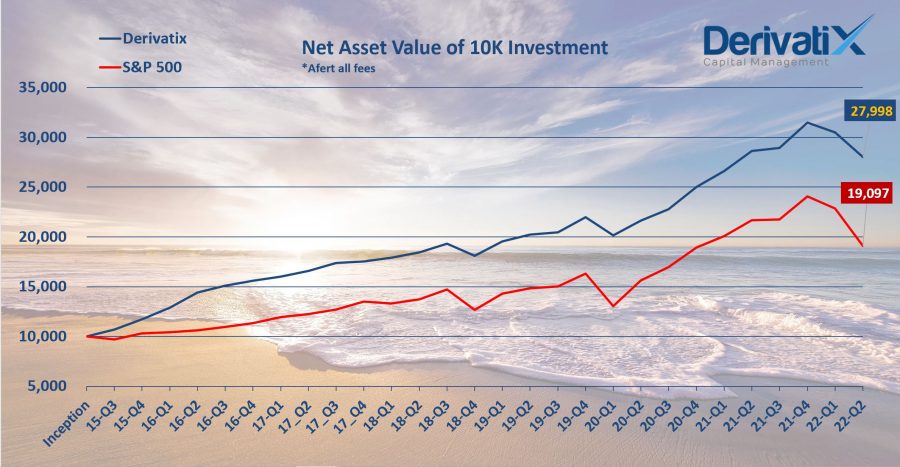

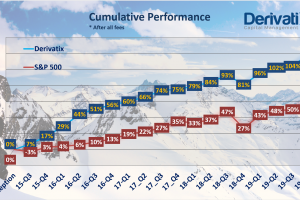

The S&P 500 Index and NASDAQ declined -16.4% and -22.7%, respectively in Q2, while dropping -20.6% and -29.6%, respectively during the first half of 2022. During this tough period, we managed to observe the majority of the market pressure, thanks to our protections in place, to limit the decline levels to -8.10% for the Q2 and -11.1% for the year (Net after all fees).

Looking at the long-term performance, Derivatix experienced a moderate -2.15% decline in the last 12 months while the S&P 500 Index and NASDAQ dropped -11.9% and -20.9%, respectively meantime. Entering the second half of the year, we continue to protect the principal in the first place while looking for signs of strength and recovery in the overall market

Source *: Global X

Recent Comments