Market Summary*:

US equities ended the quarter higher, primarily driven by gains in June. The market advanced amid moderating inflation and signs of resilience in the US economy despite higher interest rates. The Federal Reserve (Fed) raised rates in May but paused in June, with two more rate hikes predicted for 2023. Inflation declined, and the economy remains in good health, though there were some concerns about the US debt ceiling at the start of the quarter, which were later addressed through legislation.

The information technology (IT) sector led the market’s growth, fueled by excitement around AI and related technology. Consumer discretionary and communication services sectors also performed strongly, while energy and utilities lagged behind.

Derivatix Performance:

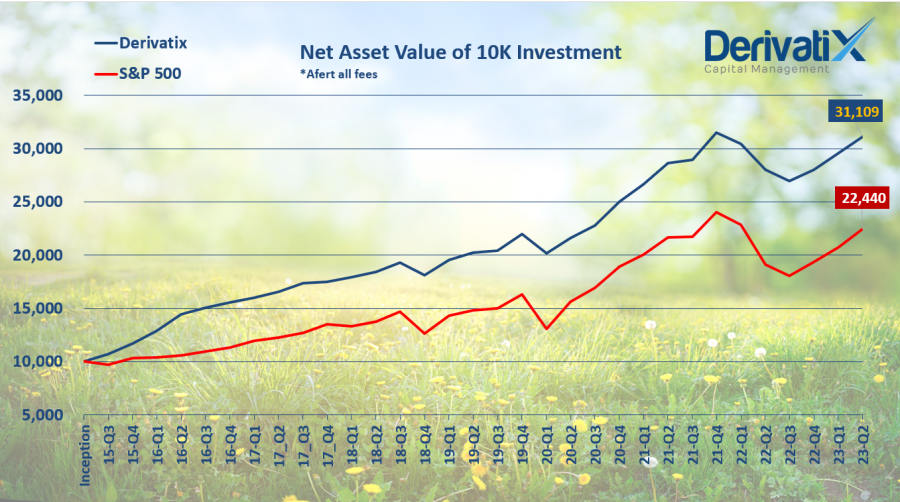

In the second quarter of 2023, Derivatix achieved a return of 5.1%, which was slightly below the market’s gain of 8.3%. We want to emphasize that this lower quarterly result is a deliberate outcome of our cautious approach and focus on smart risk-taking with an emphasis on capital protection.

During the quarter, market volatility increased, and we maintained a prudent investment strategy to navigate uncertainties and protect our investors’ capital. While this approach may have resulted in a slightly lower return for the quarter, it aligns with our commitment to long-term success and safeguarding your investments.

Over the past year, Derivatix delivered a solid return of 11.1%, staying competitive with the market’s gain of 17.5%. Similarly, over the past two years, our fund demonstrated a strong performance with an 8.7% return, outperforming the S&P500 return of 2.3%.

Our investment team remains steadfast in implementing our proven investment strategies and effective risk management approach, ensuring that we continue to maximize returns while prioritizing the protection of your hard-earned capital.

As always, we appreciate your trust and confidence in Derivatix.

Source *: Sunlife

Recent Comments