Market Summary

The US markets had a strong start to 2024, with the S&P 500 setting new all-time highs in the early months of the year. Resilient corporate profits and expectations of policy easing from the Federal Reserve fueled the market’s upward momentum. However, the market performance remained concentrated, with the largest stocks in the index continuing to dominate.

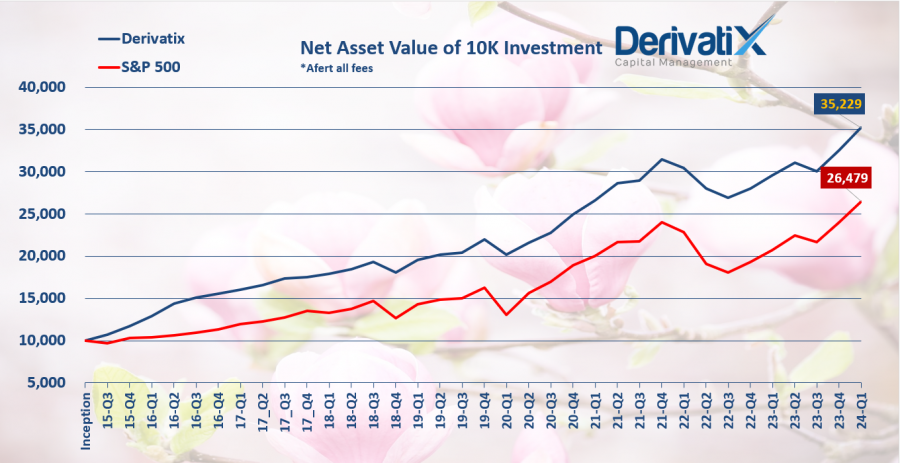

Derivatix Performance

The Derivatix fund delivered solid long-term performance, returning 15.6% over the past 2 years and 19.0% over the past 1 year. However, the fund’s 3-month return of 8.15% lagged the broader S&P 500 index, which returned 10.05% over the same period.

This lower short-term performance is a deliberate outcome of Derivatix’s cautious approach and focus on smart risk-taking with an emphasis on capital protection. During the quarter, market volatility increased, and the fund maintained a prudent investment strategy to navigate uncertainties and protect investors’ capital. While this approach may have resulted in a slightly lower return for the quarter, it aligns with Derivatix’s commitment to long-term success and safeguarding investors’ investments.

Over the past year, Derivatix has outperformed the S&P 500, with a decline of only -2.9% compared to -9.2% for the market. Similarly, over the past two years, the fund has returned 11.2% compared to 2.3% for the S&P 500. This consistent outperformance is a testament to Derivatix’s disciplined approach to risk management, which has helped the fund navigate market fluctuations and capitalize on opportunities.

The Derivatix team remains steadfast in implementing their proven investment strategies and effective risk management approach, ensuring that they continue to maximize returns while prioritizing the protection of investors’ capital. As always, Derivatix appreciates the trust and confidence of its valued investors and remains focused on delivering strong results over the long term.

Recent Comments