The amazing fall season is here. Enjoy it before it is gone as once a wise man said “Fall is a second spring when every leaf is a flower. It is more the season of the soul than of nature.”

Looking into the last quarter, it is noticeable that during Q3, the Federal Reserve and other central banks eased monetary policy in an effort to help global growth momentum. However, further escalation of the US-China trade conflict continued to weigh on confidence, and it remains unclear whether monetary easing alone is sufficient to catalyze economic acceleration. All these uncertainty left the market direction undecided within Q3.

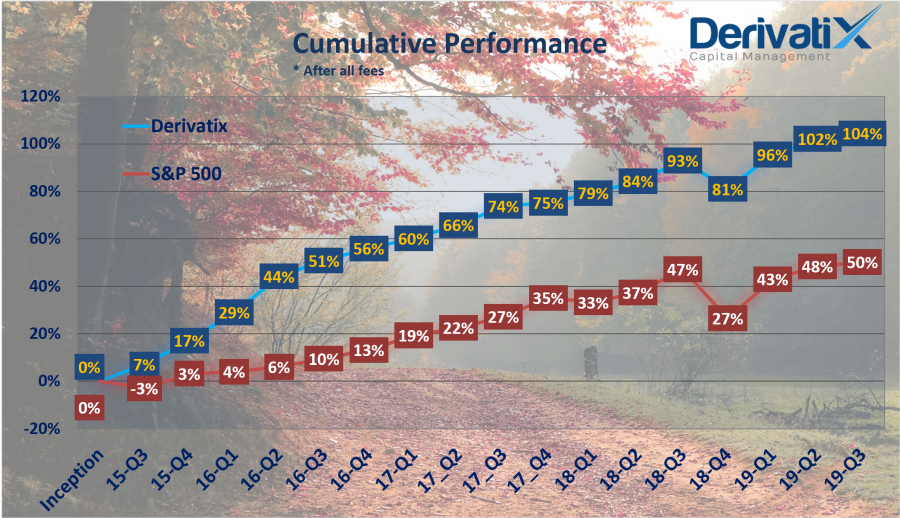

Following a volatile condition in the first half of this quarter which led to a modest loss on the main indices, the US market started a steady growth in the second half and recouped the prior drop. By the end of Q3, both S&P500 and Dow Jones made a moderate 1.3% gain. In Derivatix, we not only stayed competitive with these indices on almost the same growth rate but also managed to make a new all-time high on the fund performance record in Q3 and land above 104% net profit after all fees since inception.

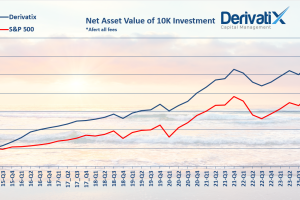

In the last 12 months, the US market has experienced a large 20% drop in late 2018 followed by a sharp rally in early 2019. The overall movement of this huge volatility made a deep V-shaped pattern in the market. These types of behaviors cause massive panic and forced many investors to get out of their positions at the worst possible time and then miss a good move up afterward. Protecting your positions using financial derivatives primarily Options, prevents such huge instability which in turn results in a more reliable gain within much manageable volatility.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.