It is mid-May 2019. The sun shines more. It is time for outdoor activities. So, we keep the report short and to-the-point:

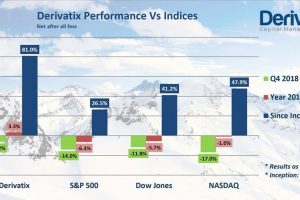

The second quarter of 2019 was fairly a quiet period so far. In the first half of this quarter, the US market continued the rally it started since the new year which eventually led to a new high on May 1st. However, the market started to lose the momentum ever since and lost part of the gain within the month of May. By mid-May, S&P500 was up only less than 1% while Dow Jones went to a negative area for the quarter. At the same period, Derivatix managed to make 1.3% net profit (after the fees) beating both indices. That happened thanks to our unique sideway strategy in place.

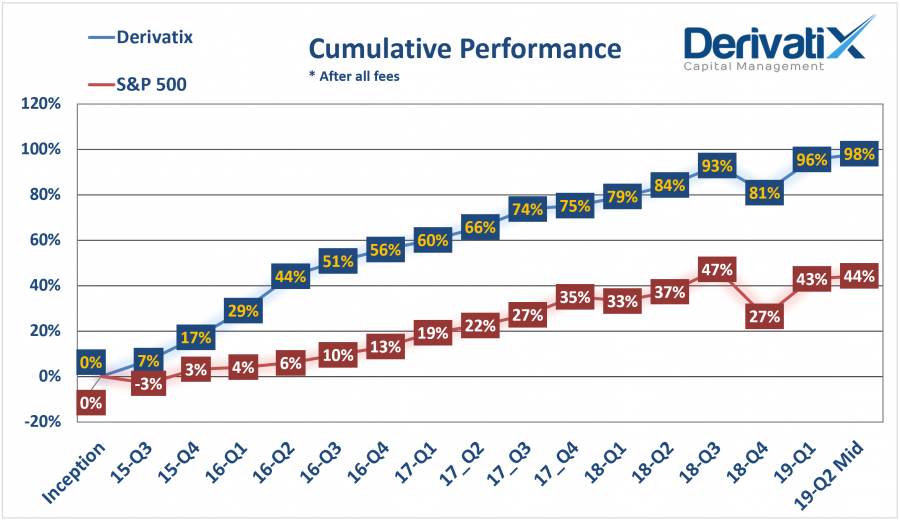

Looking long term since inception (more than 3.5 years ago), Derivatix has made 98% net profit (after all fess) for its initial investors while S&P500 and Dow Jones were up 44.3% and 55.5% respectively. This translates to 20.2% average annual return for the fund which is almost double the average return of S&P500 meanwhile. The expectation is to keep this rate throughout the rest of 2019. We welcome you to join and enjoy the ride!

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.