As the leaves begin to change and the air grows crisp, we’re pleased to present the latest insights from our Derivatix Quarterly Report for Q3 2023.

Market Summary*:

In the third quarter of 2023, global equities experienced a shift in performance, posting a negative return following robust gains in the first half of the year. Government bonds faced a similar decline as yields increased, signaling a shift in the economic landscape. Notably, commodities, particularly in the energy sector, outperformed the market due to gains driven by oil production cuts.

US equities struggled in Q3 as investors entered the quarter with optimism that the Federal Reserve (Fed) had successfully managed a soft landing for the economy, leading to expectations of a near end to the tightening of monetary policy. However, this enthusiasm waned over August and September as the prospect of a sustained period of higher interest rates set in.

Derivatix Performance:

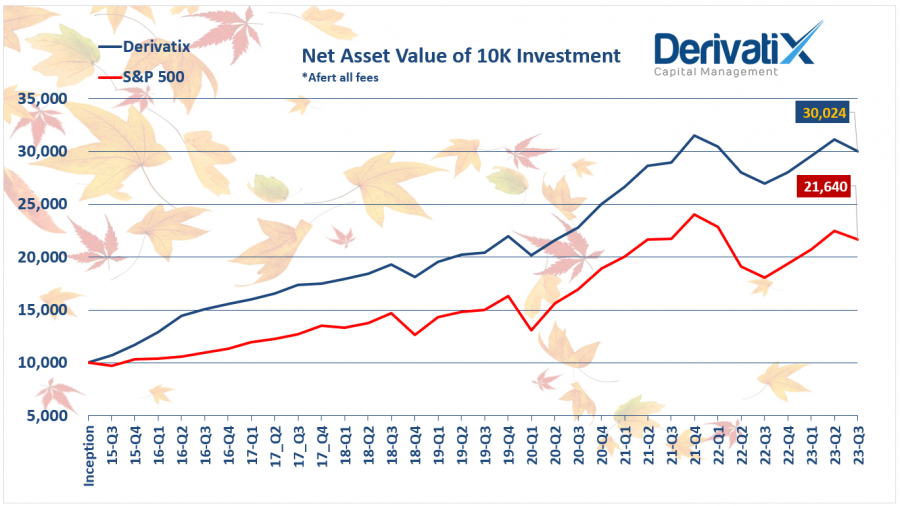

The third quarter proved to be a challenging period, with Derivatix recording a -3.4% return, slightly outperforming the S&P 500 Index, which posted a -3.6% return. The market environment during this quarter was marked by uncertainty and shifting dynamics, which had an impact on the performance of many investment portfolios.

In contrast to the short-term performance, Derivatix’s long-term track record remains solid. Over the past two years, our fund recorded a 3.8% return, which outperformed the S&P 500 Index’s -0.4% return.

While we acknowledge the challenges of the recent quarter, our investment strategies continue to prioritize the long-term objectives and interests of our valued investors. We remain committed to navigating dynamic market conditions and optimizing returns over time.

As we move into the final quarter of the year, we appreciate your trust and partnership with Derivatix and are available to address any questions or concerns you may have.

Source *: Schroders

Recent Comments