2021-Q4 Market Summary*:

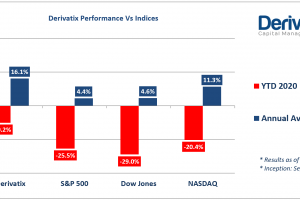

It was a wild year in many respects, but the stock market turned in a solid performance in 2021. Except for a few brief sell-offs, the S&P 500 gained 26.9% for the year. The Dow Jones Industrial Average (DJIA) gained 18.7% in 2021, while the Nasdaq Composite gained 21.4%.

Time and again, investors brushed off news that could’ve derailed stocks in years past. A contested presidential election, an assault on the Capitol, historically high inflation, supply chain disruptions, naysayers who forecasted a correction that never appeared—none of these events stopped stocks from notching all-time highs. Not even the still-raging global Covid-19 pandemic, or its Delta and Omicron variants. In fact, the S&P 500 notched 70 all-time highs in 2021, a record that’s second only to 1995.

Derivatix Performance:

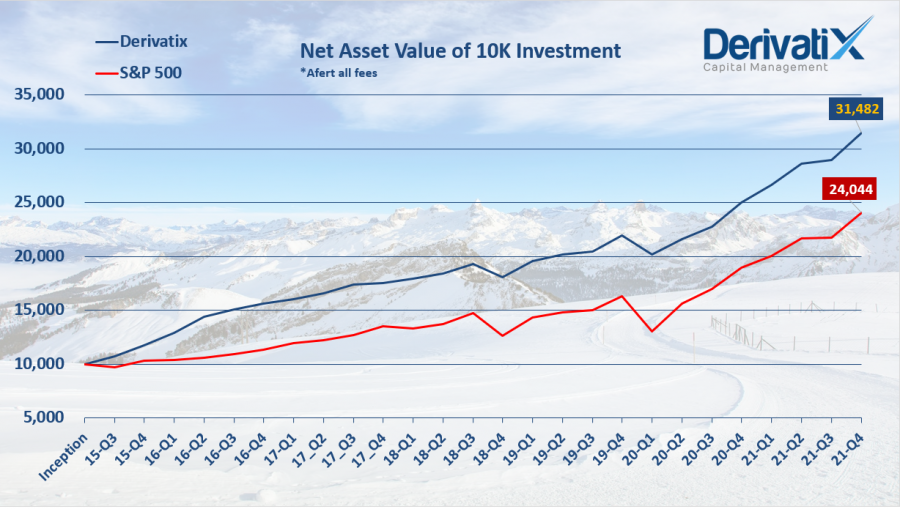

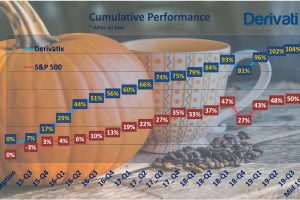

Derivatix stayed competitive to the overall market in the 4th quarter of 2021. The fund gained 8.81% net profit (after all fees) in this period and 25.9% for the overall 2021. This helps the long-term net return of the fund (since inception on Sep. 1st, 2015) to land at 215% level compared to 140% S&P 500 gain in the meantime.

2022 Outlook**:

As 2022 begins, the overriding message from almost 50 financial institutions across Wall Street and beyond is that conditions still look good, but the rip-roaring rallies powered by the reopening are history. Growth will ease. Returns will moderate. Risks abound—but so do opportunities.

We, at Derivatix keep protecting our positions by utilizing advanced risk management tools, while constantly capturing arising opportunities presented by the market in the new year.

Source *:Forbes **:Bloomberg

Recent Comments