Happy spring to all who have been waiting long for outdoor activities….

2022-Q1 Market Summary*:

U.S. equities closed out their first quarterly loss in two years due initially to soaring inflation and the Fed’s hawkish pivot. Economic measures of inflation had already reached 40-year highs in the previous quarter, with the November CPI registering +6.8%, before climbing higher in consecutive months to the most recent reading of +7.9% in February.

With global economies still adjusting to Covid’s impact on supply chains and the shift in consumer spending, Russia’s invasion of Ukraine at the end of February was the equivalent of adding fuel to the inflation fire. Commodity and rates accelerated higher from existing uptrends as the West imposed strict sanctions on Russia’s economy and central bank. Ironically, most U.S. equity benchmarks bottomed within a day of the Russian invasion.

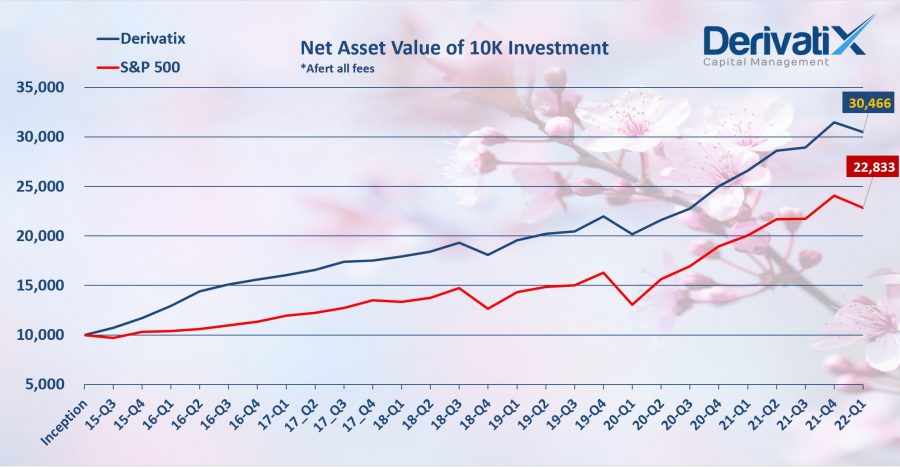

Derivatix Performance:

S&P 500 and NASDAQ had a very volatile 2022 Q1 and dropped as low as 14% and 20% before ending the quarter at about 5% and 9% loss respectively. At the same time, Derivatix encounters a small decline of only 2.74% for the quarter. This moderate change compared to the large fluctuations in the market could only be occurred by utilizing proper risk management and protection in place inside the fund which will be practiced for the rest of the year for any other potential market volatility.

Source *:NASDAQ

Recent Comments