Happy spring everyone.

Market Summary*:

The first quarter of 2023 saw moderate growth in the S&P500, with a gain of 7.0%. Market sentiment remained cautious due to concerns about inflation, interest rates, and global economic conditions. Central banks continued to monitor and adjust their policies to address these challenges. Despite the overall positive market performance, short-term fluctuations can occur due to various factors, including the short-lived market turbulence that followed the collapse of Silicon Valley Bank (SVB) in March. The Fed raised rates twice during the quarter, and data indicated that inflation is cooling, leading to expectations that the hiking cycle could shortly come to an end.

Derivatix Performance:

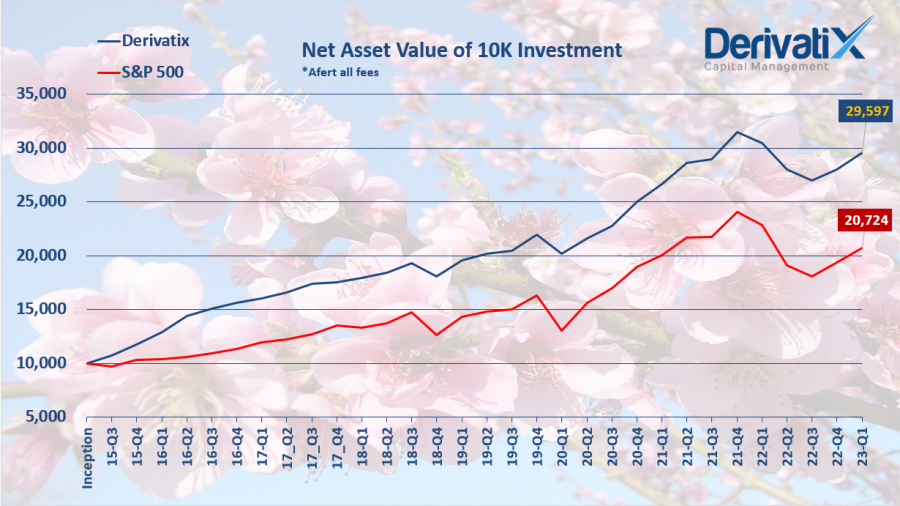

While Derivatix fund’s performance of 6.3% in 2023-Q1 was slightly below the S&P500’s growth, it’s important to view this in the context of our long-term performance. Over the past year, our fund has outperformed the S&P500, with a decline of only -2.9% compared to -9.2% for the market. Similarly, over the past two years, our fund has returned 11.2% compared to 3.3% for the S&P500. Since inception, our fund has delivered an impressive return of 196.0% compared to 107.0% for the S&P500.

We attribute our consistent outperformance to our disciplined approach to risk management, which has helped us navigate market fluctuations and capitalize on opportunities. Our investment strategies are designed with a long-term perspective, and we remain committed to our prudent and diversified investment approach.

As always, we appreciate the trust and support of our valued investors, and we remain focused on delivering strong results over the long term.

Source *: Schroders

Recent Comments