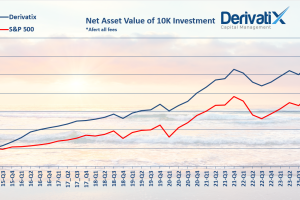

Derivatix investment strategies had an aggregate 4.8% net profit after all fees in the third quarter of 2017 while S&P500 index raised 3.8%. For the year of 2017, the fund remained competitive to S&P500 (11.5% vs 12.4%), while since inception on Sep. 1st 2015, Derivatix is up 73.8% (net after all fees) whereas S&P500 index has grown 27.2% during the same period.

Now, what is new?

2 – In order to comply better with the recent constant upward market trend, we are developing a new Dynamic Quantitative Trading System which would benefit from directional moves of equities. When implemented in Jan. 2018, this strategy will be integrated with our initial sideway strategy on indices to add more diversification and strategic investment to our portfolio. This new system is based on a comprehensive quantitative market research and has been in real time testing since second quarter of 2017 with promising results and stable returns, which we will share with our investors in the upcoming announcements.

3 – We are expanding our fund management activities to new jurisdictions beyond US by registering a new fund to accommodate more geographically diversified clients in Q1 2018.

4 – We are planning to provide regular educational materials on general market dynamic and how an investor can be equipped with derivatives for better protection and profitability. Stay tuned…

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.