So how we performed in 2017?

In 2017, the major US indices accelerated their uptrend. For instance, as of the date of this report (end of Nov. 2017), the S&P and Dow Jones Industrial Average, have experienced double percentage growth in 2017 compared to their progress during the entire 2016. This is even much larger in the case of NASDAQ with 5 times! more growth in 2017 vs 2016 (percentage wise). That was an unfavorable condition for our non-directional strategy all around the year which led us to give up part of the fund’s monthly profit to further protect the capital and tighten our management on the risk. The good news is that, with the integration of the aforementioned directional system in January, the fund would be more adaptable to the trending condition of the market.

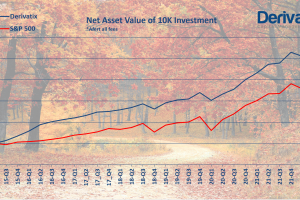

Derivatix experienced 1.2% loss in October which was later covered in November on a 3.8% profit. This placed the overall profit of the fund in Q4-2017 and 2017 at 2.6% and 14.4% respectively. On the other side, S&P500 has been made 5.5% for the Q4-2017 and 18.6% in 2017. On a longer term, Derivatix has made more than 78% net profit since inception 27 months ago. This is equivalent to 30% APR, Annual Percentage Rate.

We have planned an online information session on Thursday Dec. 21st to cover more detail on the fund’s trading strategies and the terms and conditions to join it as a new investor. To attend this event, please register here:

https://goo.gl/forms/kwQcKeI01wm1hVs32

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.