2022-Q3 Market Summary*:

The S&P 500 decreased by -5.3% in the third quarter bringing the year-to-date decline to -24.8%. Through nine months, the stock market is having its worst start to a calendar year since 2002 and is still in the bear market territory. The market finished the quarter with a whimper as the S&P 500 closed at the new year-to-date low of 3,586, a level it first reached in November 2020. The primary factors driving the market weakness still remain, including, inflation, the Fed tightening monetary policy, higher interest rates, the Russia/Ukrainian war, and China’s Zero-Covid policy. More recently, we can add the potential European energy crisis and the United Kingdom’s economic mess to the market’s wall of worry.

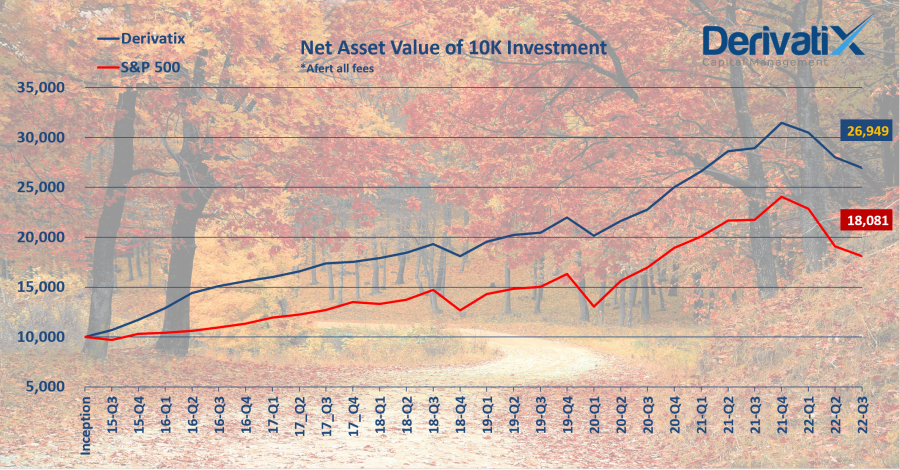

Derivatix Performance:

As mentioned above, the S&P 500 Index declined -5.3% in Q3, while dropped -24.8% within 2022 as of the end of September. For the same period, Derivatix experience a moderate -3.75% decline for Q3 and -14.40% for the year (Net after all fees). Considering a longer-term view, while the S&P 500 Index and NASDAQ plummeted -16.82% and -25.34%, respectively in the last 12 months, the effective risk management methodology employed inside the fund, helped it to stay above a modest -6.86% decline meantime.

We keep applying a high level of protection within the fund to preserve the capital as the main objective while monitoring the overall market to seize new opportunities.

Source *: Winthrop Wealth

Recent Comments