Market Summary*:

The final quarter of 2023 brought significant gains, largely propelled by growing investor confidence that the Federal Reserve Board had concluded its campaign of raising interest rates to counter inflation. There was even speculation that the Fed might shift toward cutting interest rates in the coming months. The persistent strength in the job market and robust consumer spending further contributed to strong economic growth and corporate profits, thereby driving stock prices higher.

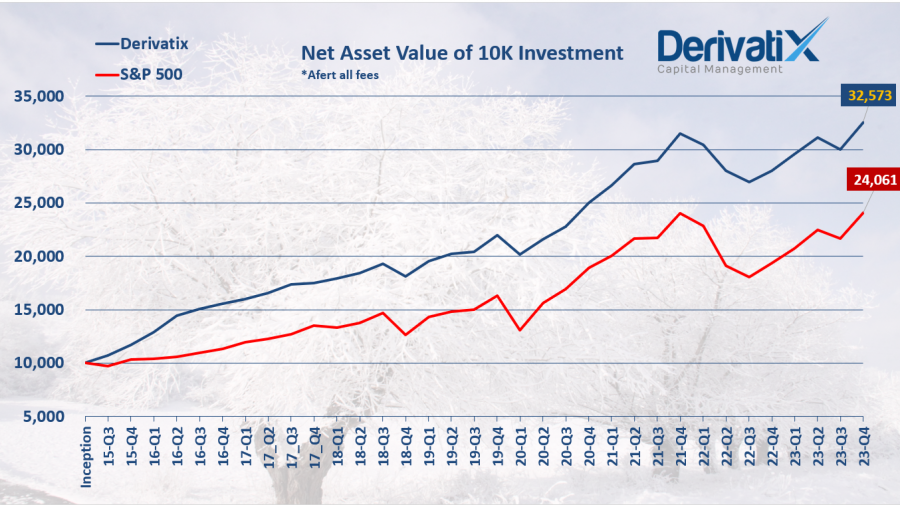

Performance: In the fourth quarter of 2023, Derivatix achieved an impressive rate of return of 8.7%. While this slightly lagged behind the S&P 500 Index’s return of 11.2%, it signifies a robust performance in the context of the broader market dynamics.

Over the past year, our fund delivered a solid rate of return of 16.3%, demonstrating resilience in comparison to the S&P 500 Index’s return of 24.3%. Looking at the two-year performance, Derivatix posted a return of 3.5%, outperforming the S&P 500 Index’s marginal return of 0.1%.

The positive momentum in the market during Q4 can be attributed to the perceived change in the Federal Reserve’s approach, coupled with the sustained strength in economic indicators. As always, we remain committed to navigating market dynamics with a focus on long-term success and the best interests of our investors.

Source *: Horizon Investment

Recent Comments