As we are getting more and more into the beautiful fall, we would like to take this opportunity to wish a happy thanksgiving to our Canadian investors before covering the market outlook in 201 Q3 and Derivatix fund’s performance meanwhile and within the year.

2021-Q3 Market Summary*:

Developed market equities were broadly flat over the quarter after a moderate decline in September erased the quarter’s prior gains. However, this still leaves developed market equities sitting on strong gains for the year to date. Chinese equities have struggled though and dragged emerging market equities down over the quarter, despite some markets, such as India, continuing to perform well. Equities held up over the quarter despite some concerns about a peak in the rate of economic growth, supply disruptions and rising inflation. Ultimately, investors still believe that, despite a moderation in the pace of growth, recession risk remains low. Expectations for ongoing earnings growth in the coming years are therefore helping to support equity markets

Derivatix Performance:

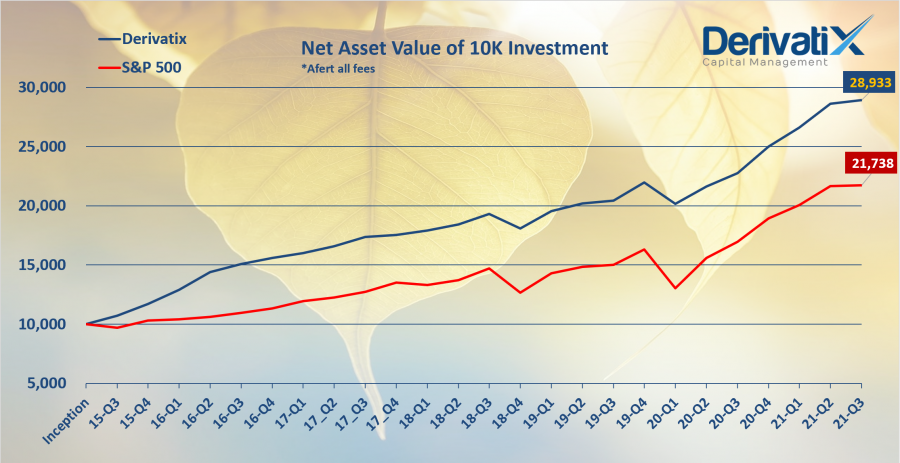

Within the early part of the quarter, the US market experienced a large run and made a new all-time high. However, the decline in September erased almost all prior gains and put the S&P 500 at only 0.3% growth. However, Derivatix fund gained more than 1% for this quarter and 15.7% for the year in net profits after all fees, beating the S&P500 on both short and long periods.

In the long run, Dervative fund has made 186% net profit since its inception years ago compared to 108% growth in S&P500. This translates to 19% average annual fund’s growth while the benchmark’s growth was at 13.6% meanwhile.

*: Source: J. P. Morgan

Recent Comments