2021-Q2 Market Summary*:

U.S. equity benchmarks closed the first half of 2021 at or near record highs as the economy continues its reopening and more and more people are returning to work. Historic fiscal and monetary stimulus has provided a consistent tailwind since the Spring of 2020, and there is little evidence those efforts will be removed anytime soon.

After stumbling out of the gate in January, the flagship S&P 500 has strung together five consecutive monthly gains and finished the first half of 2021 with a total return of 15.2%. Smaller caps have outperformed, led by Russell 2000 (+17.6% YTD). The Nasdaq 100 (NDX) underperformed with a relatively modest gain of 13.3% YTD; however, this is more than respectable given the large-cap growth index outperformed the S&P 500 by more than 30 percentage points in 2020.

Derivatix Performance:

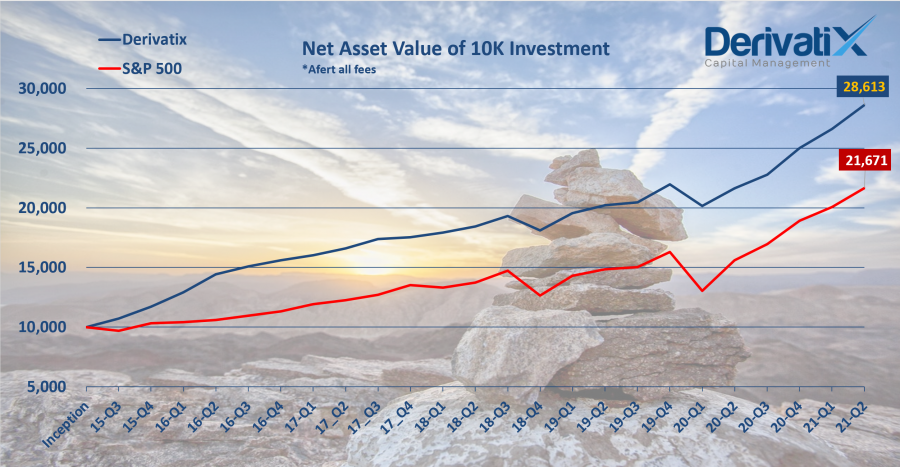

In the second quarter of 2021, the Derivatix fund stayed competitive compared to the major market indices. The fund gained 7.5% in net profit after all fees in this quarter which in turn led to a net profit of 14.4% for the mid-2021 and 186.1% since inception. The long-term average net profit of the investors since inception is now at 19.7% annually compared to a 14.2% annual growth for the S&P 500 in the same period.

*: Source: Nasdaq.com

Recent Comments