It is the summer of 2019 and while some areas in the world are experiencing an extreme heatwave, we are glad to celebrate reaching the main landmark in Derivatix performance history. First, let’s have a brief review on the US market in 2019-Q2:

Despite a sharp fall in May due to concerns over the US-China trade war, S&P 500 gained 3.7% in Q2 and set a new record high in the late quarter. Investors are generally optimistic about the progress in trade tensions by the end of June and while the Federal Reserve did not cut interest rates at its June meeting, but indicated that there may be rate cuts ahead. All these positive expectations pumped a new round of strength into the market.

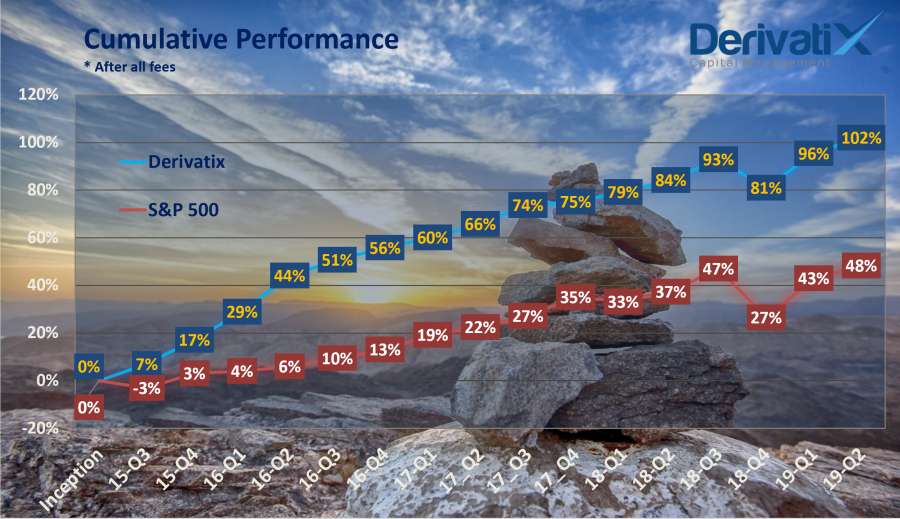

Now, here is the exciting news: For the first time in Derivatix’s history, the fund passed the 100% net profit milestone since inception. In Q2, Derivatix made 3.4% average net profit (after all fees) for the investors. This led the fund to pass the 100% net gain milestone since inception for the first time and reach 102% overall profit in less than 4 years of operation. In the same period, the main US market index (S&P 500) gained less than half this growth (48.3%).

In Derivatix, capital preservation is our first and foremost goal. We kept protecting our capital against any potential drop in the market even in the periods that the market is flourishing high and every modest person can make money by chance. Although this approach can cost us a lower gain than the benchmark in the short run, it has helped us to secure our capital in a tumbling period and thus be the leader in the long run.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.