Ladies and gentlemen! here is the Spring. Now is the time of the year to enjoy the warm weather and outdoor activities you have been waiting for.

But first let see, how has been the US market lately? Well, it has gone through a deep V-shape move. Three months sharp down and then three months rally up (so far); the bottommost was exactly the Christmas day! I recall a conversation I had with a friend of mine on Christmas eve in a cottage. While we were enjoying a well-cooked turkey by another friend at the dinner table, she was so nervous about the continuous drop in the market and asking me whether this time, it is the end of the world. My answer was “Not yet, keep tight to your long-term positions but make sure to add some protection to them in case the market keeps going down”. In fact, that’s exactly what we do in Derivatix on any direction of the market: Either Up or down. Financial Options are primarily invented as a tool of mitigating the directional risk, so any investor must learn and use them for that purpose. Don’t take any exposure unless you understand, measure and manage your market risks.

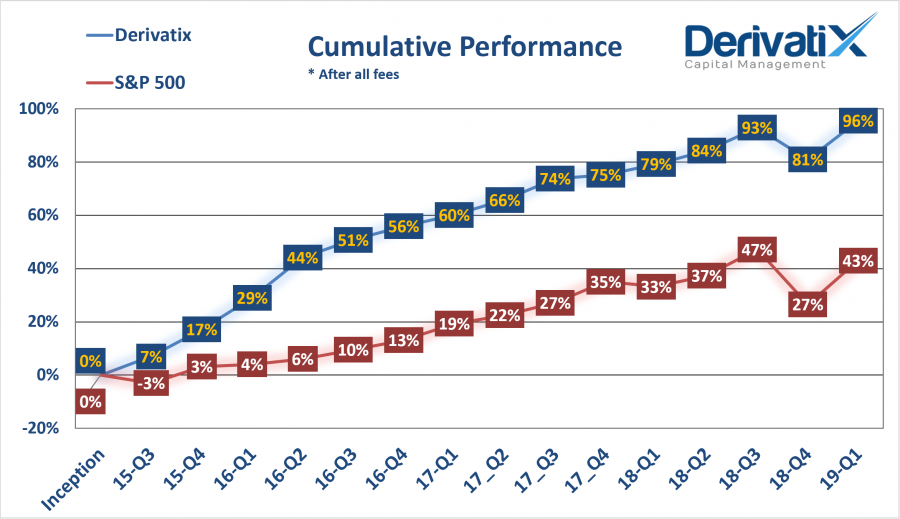

Looking closely at S&P500 index deep swing, it shows a large 14% drop in the last quarter of 2018 and then a big 13% growth in the first quarter of 2019. At the end, the overall growth in this 6-month wide V-shape is still negative 2.8%. Meanwhile, Derivatix had only 6.2% decline in the last quarter of 2018 and then a reasonable 8.0% growth in the first quarter of 2019: At last, the overall growth of Derivatix in this 6-month process is positive 1.3% compare to -2.8% for S&P500. *

Long story short, thanks to the protections in place, the fund experienced less drop in late 2018 yet due to the cost of protections still in place it then made less profit in early 2019. In the long run, the result was in our favor: Derivatix made better result than the benchmark in a more manageable volatility.

*: The overall result of multiple periods have to be calculated based on the time-weighted return (TWR) method.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.