It is finally the spring time ladies and gentlemen. However, we have to still enjoy it from the comfort of our home while keeping track of Coronavirus pandemic news and the market volatility.

2020-Q1 Market Summary:

The longest bull market in US history ended sharply in the first quarter of 2020 as the markets were severely impacted by the inception of the coronavirus.

The S&P 500 which is the major U.S. market index, fell into the bear market territory in just 22 days which was the sharpest record ever and continued further dropping 30% in a record 30 days. The typical historical bear market peak-to-valley decline has taken around 12 to 18 months before.

Although this was the biggest quarterly decline since 2008, U.S. large-cap stocks were the best performers once again with a -19.6% drop while small-cap stocks were the worst performers, declining 40% at the bottom and 30% for the quarter. I addition, energy markets were especially hard hit, and oil prices had their biggest one-day drop since the 1991 Gulf War, plunging 25% on March 9, triggered by a price war between Saudi Arabia and Russia.

Derivatix Performance:

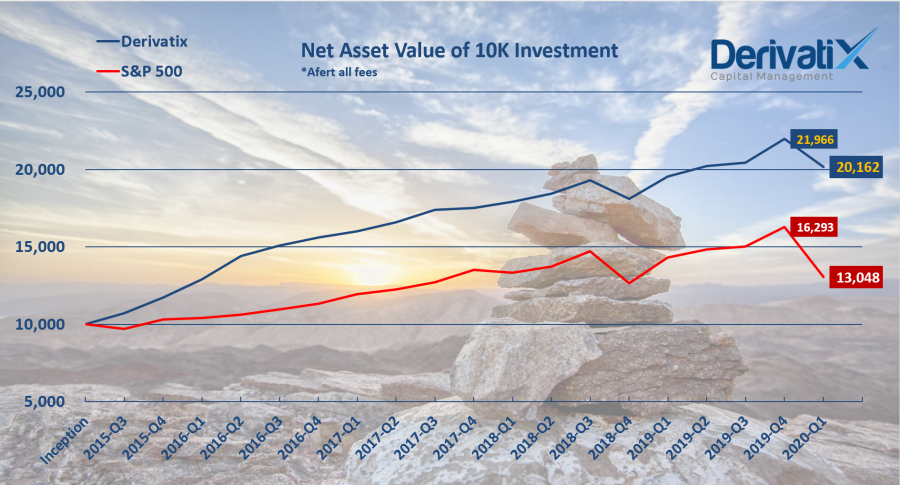

Derivatix performed relatively well in the first quarter of 2020. While the S&P 500 dropped up to 30% and finish the quarter at 20% final loss, Derivatix ended this high volatile quarter with an 8.2% decline. In the long term since inception, Derivatix is still above 100% net profit while S&P 500 raised only 30% meanwhile.

Even though it was a very difficult, abrupt, and historic fall in the market, we managed to absorb the majority of this shock by constantly hedging our positions with financial derivatives-mainly options. Our solid risk management methodology enabled us to smooth out the exposure of our portfolio to the market. This methodology also helped us keeping our long term positions while being prepared for the market’s short term wild volatility. In a nutshell, we reduced our downside exposure dramatically to the extent that more market decline wouldn’t hurt us as much as its initial drop.

Inevitably, adding such protections incurred large costs. It means reducing downside exposure comes at the cost of lowering the profit on the upside at the same time. That was done for the main goal of preserving the capital first and then making the profit when the dust settles.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.