In line with some countries’ decision to re-open their economy in steady steps, the overall US market manages to make a substantial V-shaped rebound from the bottom made in late March.

2020-Q2 Market Summary:

Right after the S&P 500 experienced the sharpest record drop of 30% in about a month and Russell 2000- the small-cap index plummeted even further to 40% in the same period, a very fast recovery started to shape in both markets. By the mid current quarter, both aforementioned indices managed to recover more than half their sharp drop and are in the path to recover even further.

Derivatix Performance:

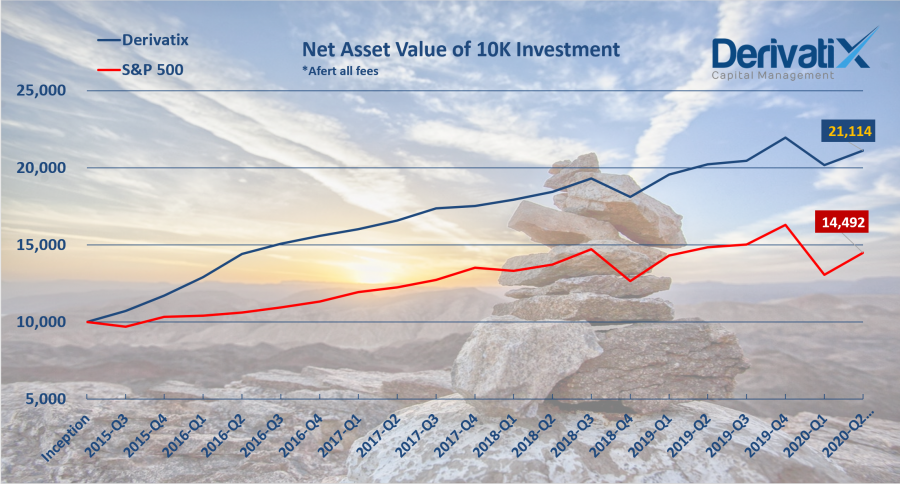

As mentioned in our Q1 report, thanks to our protections in place, we managed to absorb most of the harsh decline and eventually land on about 8% loss- compared to a 20% drop in the S&P 500 at the end of last quarter.

We kept adding more protections just in time for any possible and continued drop in Q2. They helped us to maintain our long-term positions for the recovery while substantially reduce our downside exposures.

Even though this mechanism imposed a large amount of cost ensuring our positions and thus reducing our upside acceleration, we managed to stand at a better rate of return in the overall process in Derivatix for the year to date. We recouped more than half our losses by mid-Q2 and in overall stand at only a 3.9% decline for the year to date. In the same period, S&P 500 is still experiencing an 11% decrease in 2020.

For the rest of the year, we keep monitoring the market closely for any potential large move to effectively execute subsequent protections and manage the market risk accordingly. It is the time of the year that we encourage you to consider joining other investors in Derivatix and ride with us for the remaining of 2020.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.