During the Q1 of 2020, the market plunge came as the coronavirus pandemic ground the economy to a halt and millions of people lost their jobs. The 30% drop in the first quarter of the year in the S&P 500 was the market’s worst quarter since the 2008 financial crisis. However, this index started the recovery in late March and ended Q1 at a 20% loss.

2020-Q2 Market Summary:

The recovery continued into Q2, helping S&P 500 to grow another 19.6% to stay on only 4.2% loss for the year at the end of June. In fact, it was the best quarter since 1988 as the market screamed back toward its record heights after a torrid plunge. The overall 6-month process has been a gigantic roller coaster ride for the global economy so far.

Derivatix Performance:

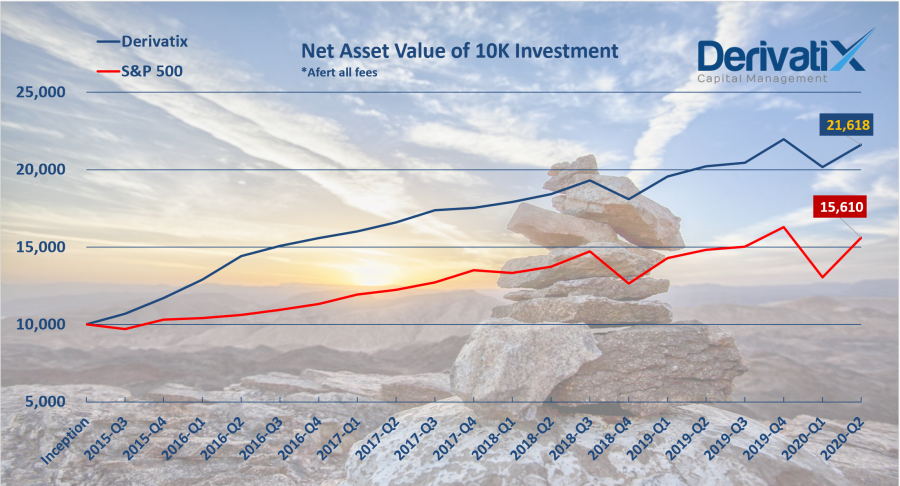

Here in Derivatix, we also experienced this economic distress. However, by reducing the exposure to this wide market volatility, we managed to switch to a much smoother roller coaster since mid Q1. This took place as we added more protections to our positions which eventually helped the fund to decline and rebound much less than the overall market.

For the entire 6-month process, Derivatix is standing at a moderate loss of 1.6% while S&P 500 is still 4.2% negative for the year. Since the inception of the fund about 5 years ago, Derivatix has made 116% net profit (after all fees) for its initial investors. In the same period, the S&P 500 has grown by 56%.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.