2020-Q3 Market Summary:

The fastest 30% drawdown in the history of global equities in the first quarter followed by the largest advance in market history in the second quarter and into the third quarter. The S&P 500 was back above 3,380 on August 12 and the Nasdaq hit a record high on August 6. Meanwhile, commentators have been lining up to claim that markets are detached from fundamentals.

Derivatix Performance:

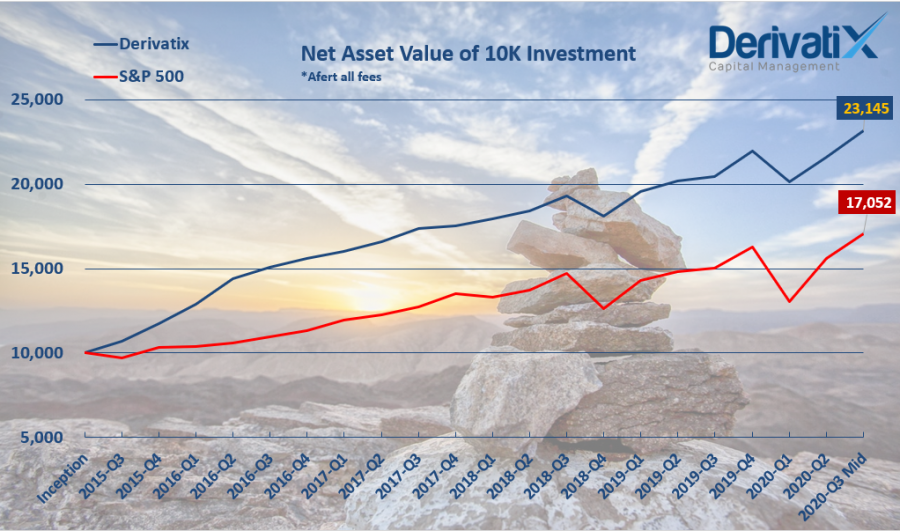

While enjoying the rally in the overall market, we keep protecting our positions on the way up in case for any corrections. This practice while eating up part of the profit, has proved to be healthy in long-run and prevented sudden shocks in our positions.

During the third quarter of 2020, Derivatix grew 7.1% in net profit. As a result, the fund returns back to the positive area of 5.4% for 2020. At the same time S&P 500 was up 9.2% within the third quarter and 4.7% for the year to date. On average, Derivatix has made 18.4% annual average return since inception 5 years ago. This is compared to 11.4% annual return for S&P 500.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.