It is Jan. 2020. Happy new year everyone!

After a year dominated by U.S.- China trade tensions, fears of a hard Brexit and a global slowdown, 2019 comes to a close on a high note, with the S&P 500 hitting a fresh record high as concerns surrounding these geopolitical tail risks have eased.

2019 Q4 Market Summary:

This recent quarter was not only the final quarter of 2019, but also the decade. We have experienced a bull market for the entire ten-year period, with no 20% bear market periods and only a few 10% corrections. 2019 was a remarkable year for investors as stocks went on sale in December 2018, and many were predicting that the bearish trend would continue through 2019 yet it changed direction and experienced well-above-average gains almost literally across the board. S&P 500 Index grew 8.45% during the Q4 and overall finished up 28.8% in calendar 2019.

2019 Q4 Derivatix Performance:

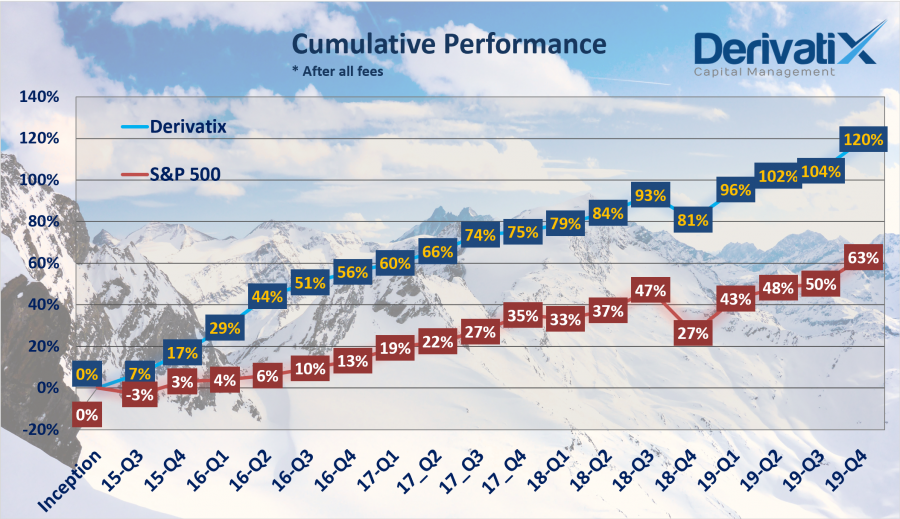

During the final quarter of 2019, Derivatix fund made 7.45% net profit after all fees and 21.4% within the entire year for its investors. This exceptional growth made 2019 the second-best performing calendar year for the fund. In a longer-term, since inception in Sep. 2015, Derivatix has marked about 120% net profit which in turn means a 19.9% net average annual profit. Meanwhile, the S&P 500 index grow 63% on an average annual return of 11.9%.

2020 Q1 Outlook:

Nobody can predict when or how the bull market will end and how deep the coming recession or bear market will be. As a result, it is very essential to protect the capital and the gains through Options. It is our practice in Derivatix to give up part of the potential profit when the market is booming for the benefit of being protected during any possible market corrections.

In overall, a J.P. Morgan Global Research offers, growth in 2020 will start at a subpar pace, before picking up some time before mid-year. Political drags will likely fade, and business sentiment should firm as the U.S. and China agree to a Phase 1 trade deal and there is more clarity on the likely Brexit deal.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.