While the world is fighting against the coronavirus pandemic, don’t forget that the spring is around the corner.

Since our last report as of Dec. 31st, 2019, there have been major changes to the US and global markets. As such, we delayed the mid report from mid-February to the end of this month to cover the effect of these changes on US indices and the performance of the fund.

2020-Q1 Market Summary:

At the beginning of 2020, consensus suggested that global economic growth would likely pick up, thanks to the trade deal with China, the passage of the United States-Mexico-Canada Agreement, and early signs of an economic pickup in European economies. As such stocks rose to new highs keeping the previous months’ momentum.

However, following the Presidents’ Day holiday, markets opened down and mounting coronavirus fears sent stocks into correction territory in the rest of the February. The Dow Jones Industrial Average lost 10%, while the S&P 500 index dropped 8.4%. The NASDAQ Composite fell 6.4% in this month.

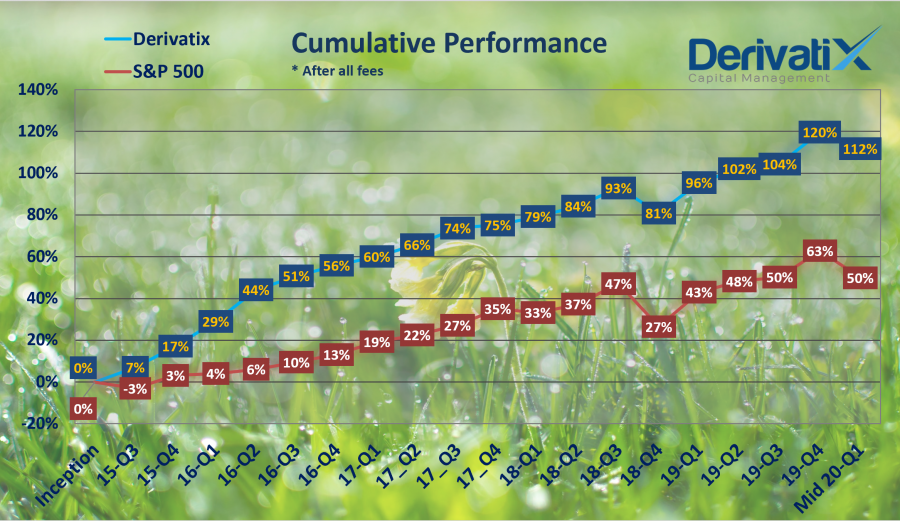

Derivatix Performance:

Referring to the last part of our previous report, it is not easy to predict when the bull market will end and how deep the bear market will be. As such, we constantly give up part of our potential profits to utilize protections in place which in turn safeguards the fund’s value against such sharp drops as happened in late February. As a result, while the S&P 500 index lost about 8% for the year, we managed to stop the loss at 3.6% level at Derivatix fund.

We predict a bumpy ride for the rest of the year, so we keep protecting the fund in the same fashion while watching for opportunities down the road for risk-managed profits. Better to be safe than sorry!

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.