2020-Q4 Market Summary*:

2020 was a year of surprises. There was the speed at which the pandemic escalated, the severity of the lockdowns, the size of the government stimulus measures globally, and the magnitude of the equity market rebounds. Perhaps the biggest surprise is that global stocks finished the year with double-digit returns —an outcome few would have predicted during a global pandemic. With the U.S. election behind us and effective vaccines on the way, investors have become bullish, pushing the S&P 500 Index to record highs.

There is a positive medium-term outlook for economies and corporate earnings. The global economy is still in the early post-recession recovery phase of the cycle. This implies an extended period of low-inflation, low-interest-rate growth that favors equities over bonds.

Derivatix Performance:

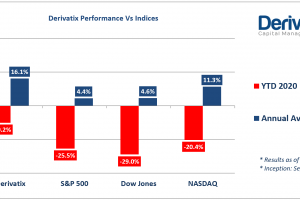

The unique behavior of the market in 2020 and the extreme challenges it forced to the capital market, tested the strength of the strategies each fund utilizes internally to react to such events. While the main US indices suffered between 25 to 40% drop in the first quarter of 2020, Derivatix showed robust stability at only an 8-9% decline.

Even though the global market started to recover within the rest of 2020, we continued our methodology to add and maintain protections in place in order to be safeguarded for any other market volatility and turbulence. Apparently, this practice has its own cost, yet it acts as insurance down the road to protect us against any upcoming market downfall.

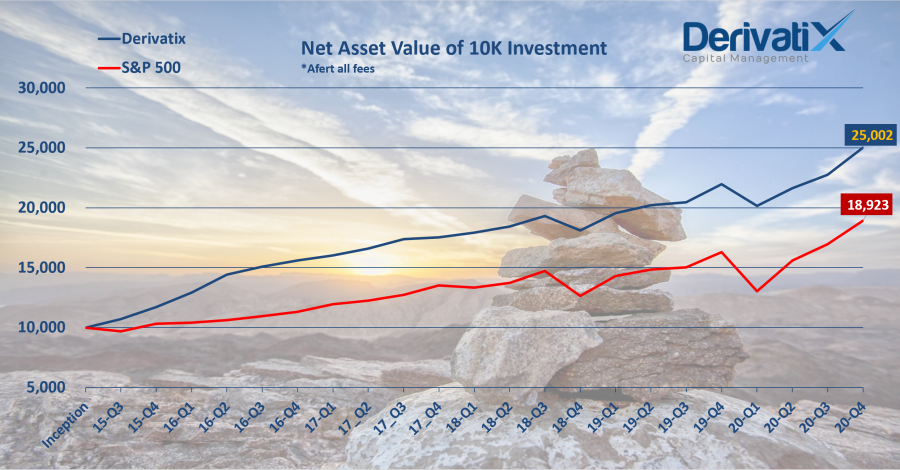

In the fourth quarter of 2020, Derivatix gained 9.8% in net profit after all fees. This helped the fund to reach a new milestone. Since its inception about 5 years ago, the fund has made 150% net profit for its initial investors which means an 18.7% average annual return meanwhile. At the same period, the S&P 500 grew only 89.2% with an average return of 12.7% annually.

*: Source: Russel Investments Global Market Outlook

Recent Comments