1. In February, the US market kept going up giving Mr. Trump the opportunity to take the total credit of this large move since election and be more proud of himself. Well Mr. President, it is too soon to celebrate; Better to wait to witness the long-term effect!

2. Anyway, all three major US market indices experienced new highs in February: Dow Jones was the leader with 4.8% gain followed by NASDAQ and S&P500 with 4.4% and 3.9% increase respectively. Since majority of the mutual funds have close correlation to the market direction, they also enjoyed a good ride at this short-term period.

2. Anyway, all three major US market indices experienced new highs in February: Dow Jones was the leader with 4.8% gain followed by NASDAQ and S&P500 with 4.4% and 3.9% increase respectively. Since majority of the mutual funds have close correlation to the market direction, they also enjoyed a good ride at this short-term period.

3. This was not an ideal situation for us since our trading strategy don’t track directional movements. In the periods that the overall market makes large directional moves, we cut part of our potential profits and spend more on protecting our capital and preserve it for when the market stabilizes. The good news is that statistically speaking, majority of times the market gyrates within its one to two standard deviation which is perfect for our sideway trading strategy. This market behavior enables us to outperform it in the long-run despite any temporary underperformance.

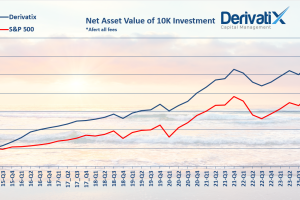

4. Derivatix made small net profit of 2.1% in February and 4.5% in 2017 so far. Even though we haven’t beaten the US market indices during aforementioned short-term periods, Derivatix is by far the leader in the long-run with 63% net profit since inception. At the same time, Dow Jones and NASDAQ have grown about 25% and S&P500 made just below 20% gain. Capital Management is a marathon run. We aim to be the winner at the finish line!

It is the tax time. We have already issued and sent tax forms to all our investors whom we had the privilege to manage their capital in 2016. We are happy to make 33% net profit for them throughout this year.

5. It is also the fund-raising time for the next round of investment (2016-Q2) starting April 1st. So far, two online info sessions have been scheduled and presented for potential investors and few more will be planned base on special demands. Our fund-raising efforts has led to new capital addition from new and current investors which has helped the fund to keep its quarterly growth in terms of asset under management.

6. Last but not least, it is the Persian New Year time! Happy new year to all who celebrate the nature revival. The beautiful spring is just around the corner. Embrace all the bright sides it brings to you!

4. Derivatix made small net profit of 2.1% in February and 4.5% in 2017 so far. Even though we haven’t beaten the US market indices during aforementioned short-term periods, Derivatix is by far the leader in the long-run with 63% net profit since inception. At the same time, Dow Jones and NASDAQ have grown about 25% and S&P500 made just below 20% gain. Capital Management is a marathon run. We aim to be the winner at the finish line!

It is the tax time. We have already issued and sent tax forms to all our investors whom we had the privilege to manage their capital in 2016. We are happy to make 33% net profit for them throughout this year.

5. It is also the fund-raising time for the next round of investment (2016-Q2) starting April 1st. So far, two online info sessions have been scheduled and presented for potential investors and few more will be planned base on special demands. Our fund-raising efforts has led to new capital addition from new and current investors which has helped the fund to keep its quarterly growth in terms of asset under management.

6. Last but not least, it is the Persian New Year time! Happy new year to all who celebrate the nature revival. The beautiful spring is just around the corner. Embrace all the bright sides it brings to you!

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.