In addition to unpleasant and pricy legal jobs, July 2016 was a very challenging month for us since the market got a direction and kept going up and up, putting an upside pressure on the Fund. Although, an upside pressure is much more manageable than a downside pressure, I still don’t like it mainly because while other traditional funds are making EASY money just riding the market, we have to patiently live under the pressure and wait for the right moment to come – like an old fisherman. OK, enough of using the word “pressure” in a paragraph. Let’s go to the result:

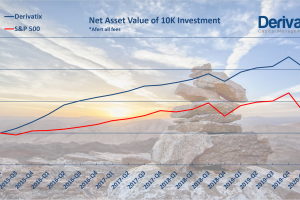

Derivatix Fund lost 3.70% in July due to the market large directional move this month. Although no one likes lost, having losing periods is part of our game. A moderate decline in the overall market would help us to regain it in the upcoming months. In July, S&P500 and NASDAQ made 3.7% and 7.2% respectively while the big winner in our study was Alphabet with about 12.5% profit this month. On the other side, the big loser was Oil which dropped more than 15% in July.

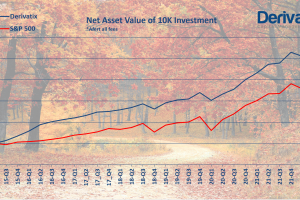

Looking longer term, the winners in the entire 2016 so far, are Gold, Derivatix Fund and Facebook with 27.1%, 18.5% and 18.4% profit respectively. The 2016 big looser is Netflix with more than 20% lost. On the overall competition since inception (Sep. 1st 2015), Amazon took the first place with gigantic 48% gain followed by Derivatix Fund at 38.8% and Facebook at 38.6% gain. Oil is still way at the bottom of the list with about 40% lost in its value since last September. More details can be found here.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.