1. The recent bull market which started after the US election, continues its movement up in April and May thus prevents us to make large profits in these two months. Derivatix made 0.8% and 1.5% after-fees profits in April and May respectively. These put the fund’s net growth in 2017 at 5.1% while S&P500 grew 7.5% and NASDAQ jumped at incredible 18.9% rate. Come on NASDAQ! What’s wrong with you?

2. Long term statistically speaking, two third of the time, the overall market gyrates in one standard deviation range of its historical move. It goes up and down but doesn’t take a specific direction. However, on the other one third it takes a directional move and keeps moving up, up and up or down, down and down.

2. Long term statistically speaking, two third of the time, the overall market gyrates in one standard deviation range of its historical move. It goes up and down but doesn’t take a specific direction. However, on the other one third it takes a directional move and keeps moving up, up and up or down, down and down.

3. We don’t like that one third directional market which force us to give up large part of our potential profit to spend on protecting the fund (especially when the market keeps going up and gives others easy profit!). But then again, it worth to preserve the capital for when the two third sweet honeymoon arrives. You know what I am talking about…

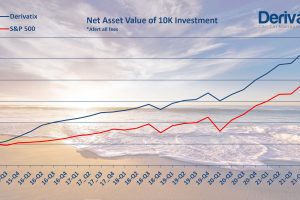

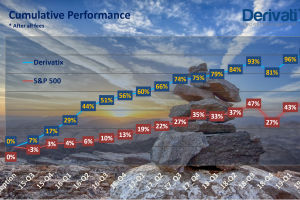

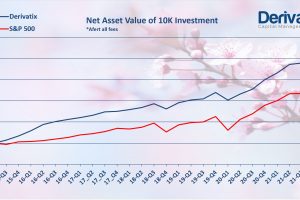

4. Anyway, long term speaking, Derivatix has made 63.8% net profit since inception (21 months ago), even though we were experiencing the unpleasant directional market move. At the same period, S&P500 and NASDAQ grew 21.6% and 35.1% respectively. Note, half of NASDAQ’s profit has happed in the last 5 months.

5. We run an online info session last Saturday while the second one has been planned for upcoming Saturday Jun. 24th 10am EST. In these online meetings, we also provide some educational materials on unique capabilities of Options in protecting your capital. I recommend it to who interested in learning more about Options. No previous knowledge of Options is needed. Here is the link for free registration:

https://goo.gl/forms/liXkzYwU5seIevzl1

7. We are approaching to the fund’s legal limit as of the number of general investors to admit. So far 22 out of 35 legally allowable spots have been filled by our existing investors from US, Canada and Europe. Moreover, new investors are in the process to subscribe into the fund for the next quarter. Don’t lose the opportunity; join us in this progressive journey before we are run out of spots!

8. Have fun in the summer!

Please note, all monthly reports are based on estimated growth and fess until the official quarterly report published for the investors.

4. Anyway, long term speaking, Derivatix has made 63.8% net profit since inception (21 months ago), even though we were experiencing the unpleasant directional market move. At the same period, S&P500 and NASDAQ grew 21.6% and 35.1% respectively. Note, half of NASDAQ’s profit has happed in the last 5 months.

5. We run an online info session last Saturday while the second one has been planned for upcoming Saturday Jun. 24th 10am EST. In these online meetings, we also provide some educational materials on unique capabilities of Options in protecting your capital. I recommend it to who interested in learning more about Options. No previous knowledge of Options is needed. Here is the link for free registration:

https://goo.gl/forms/liXkzYwU5seIevzl1

7. We are approaching to the fund’s legal limit as of the number of general investors to admit. So far 22 out of 35 legally allowable spots have been filled by our existing investors from US, Canada and Europe. Moreover, new investors are in the process to subscribe into the fund for the next quarter. Don’t lose the opportunity; join us in this progressive journey before we are run out of spots!

8. Have fun in the summer!

Please note, all monthly reports are based on estimated growth and fess until the official quarterly report published for the investors.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.