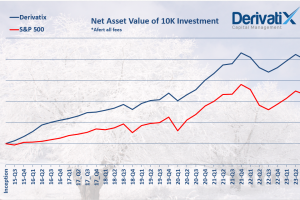

At the mid-3rd quarter of 2018 (as of Aug. 15th, 2018), Derivatix was in net 6.8% gain year to date which means that the fund has made 87.1% net profit (after all fess) since inception about 3 years ago. In comparison, S&P 500, the main market benchmark, was up 5.6% year to date and 42.6% since the fund’s inception. During this three-year period the average return of the fund for its investors have been at 23.6% per year (again net after all fess) which is about double the annual yield of S&P 500 at 12.8% meanwhile.

Derivatix has officially started its fourth year of operation. It is now a much larger fund that has extended its services to variety of individual and corporate clients from US, Canada and Europe. It was a quite great achievement to beat the US market in this period and effectively manage the market risk in a fairly balanced portfolio. We warmly thank all our investors who trusted us and gave us the opportunity to manage their capital.

We’ll soon fill the last available spots for new investors and won’t be able to legally accept any new client into the fund afterward. We highly recommend you to don’t miss this opportunity and take the last chance to ride with us. In order to provide you with more information on what competitive advantages Derivatix has and how you can benefit from our fund management service, we would run two online informational sessions in the next few days. We are also planning a private in person meeting in Toronto, Canada for potential clients in that area. Stay tuned for more announcements.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.