After a devastating 1st quarter for the global, market, followed by a 2nd quarter recovery on the back of heavy monetary and fiscal stimulus, the 3rd quarter brought continued recovery at a more moderate pace. The global economy continued its gradual reopening in the third quarter. Business activity and the job market improved, but economic challenges remained. Stocks showed some strength to begin the period. However, pandemic concerns slowed markets down. Central banks around the world kept interest rates low to help boost the economy.

2020-Q3 Market Summary:

Looking at numbers, the S&P 500 Index raised +8.6% during Q3 bringing its YTD return into the green on a +4.0% return. In mid-August, the S&P 500 Index set its first all-time high since February. The market continued to power higher until early September when valuation concerns drove a shift in performance between growth and value and market volatility increased.

Derivatix Performance:

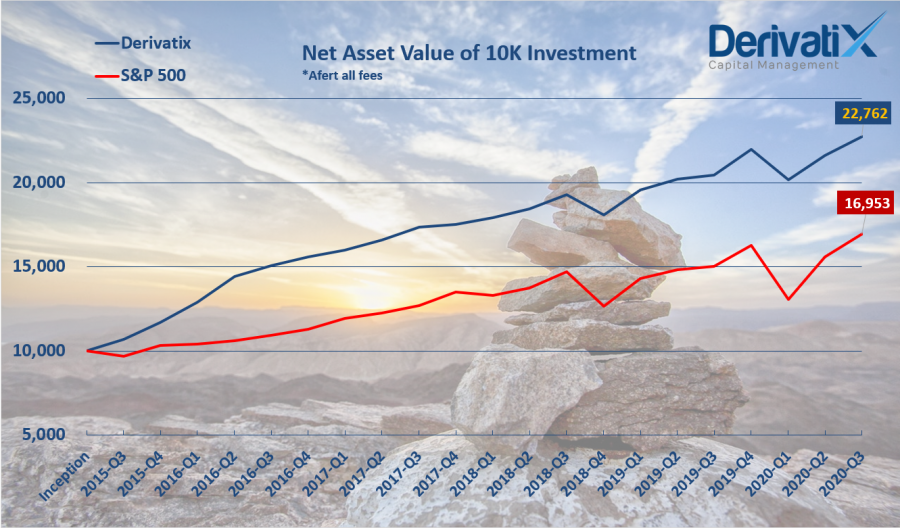

We in Derivatix stay cautious and started out to reduce the exposure since mid-quarter as we were getting closer to the US election date. During the 3rd quarter of 2020, Derivatix made a 5.3% net profit after all fees which helped to return the YTD performance on the positive side. Since inception about 5 years ago, the fund is on 127% net profit which is 17.6% average annual net return. At the same time, the S&P 500 Index grew by about 70% with only a 10.9% average annual return.

The fund would keep protecting the outstanding positions and would be on absolute cash during the US election in order to prevent the damage of any probable wild market volatility for the time being. This approach may cost the fund to experience less profit if the market rallies fast, however it is a much safer method to preserve the main capital.

Recent Comments