As summer settles in and markets continue to surprise, we’re pleased to share our second quarter update.

Market Summary

The second quarter brought heightened volatility and risk, largely driven by the announcement of aggressive new US tariffs. The sudden escalation rattled markets, triggering sharp selloffs and dramatic swings in volatility indices. While equities eventually recovered lost ground, uncertainty around trade policy and its economic impact kept risk levels elevated throughout the quarter. Investors continued to grapple with higher costs, shifting supply chains, and concerns over future growth, as the market digested the potential for lasting economic disruptions.

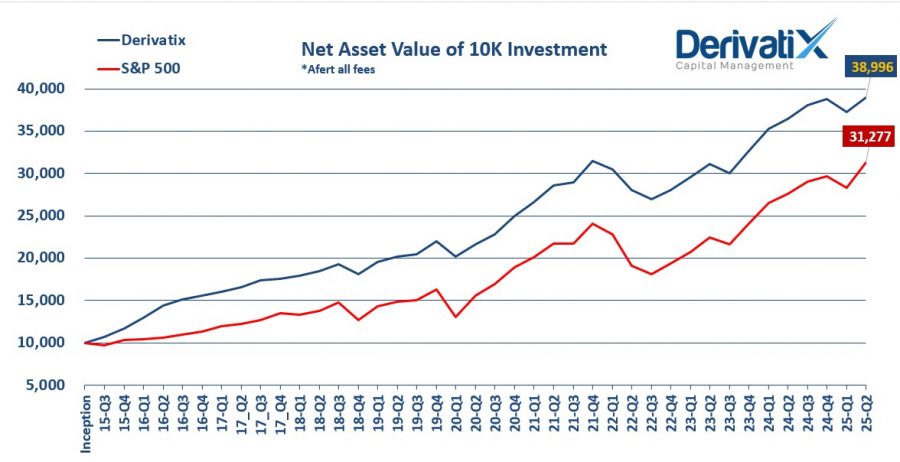

Derivatix Fund Performance

For Q2, the Derivatix Fund returned +4.8%, trailing major indices. This outcome was intentional: amid tariff-fueled volatility and rising macro uncertainty, we prioritized capital preservation over short-term gains. Our strategy involved increasing allocations to hedging and protective positions, even as headline indices rebounded from their April lows. By focusing on risk management through an unusually turbulent stretch, we protected the fund from larger drawdowns while maintaining our disciplined, long-term approach.

Since inception, the fund has achieved a +290.0% cumulative return and an annualized return of 14.7%. We remain vigilant as risks from tariffs and market instability persist, committed to navigating uncertainty and seeking steady compounding for our investors.

Recent Comments